Business Insurance in and around Benton

One of the top small business insurance companies in Benton, and beyond.

This small business insurance is not risky

Insure The Business You've Built.

It's a lot of responsibility to start and run a business, but you don't have to figure it out all by yourself. As someone who also runs a business, State Farm agent Lisa Dilts understands the work that it takes and would love to help lift some of the burden. This is coverage you'll definitely want to look into.

One of the top small business insurance companies in Benton, and beyond.

This small business insurance is not risky

Get Down To Business With State Farm

For your small business, whether it's a vet hospital, a dry cleaner, a beauty salon, or other, State Farm has insurance options to help fit your needs! This may include coverage for things like business property, equipment breakdown, and business liability.

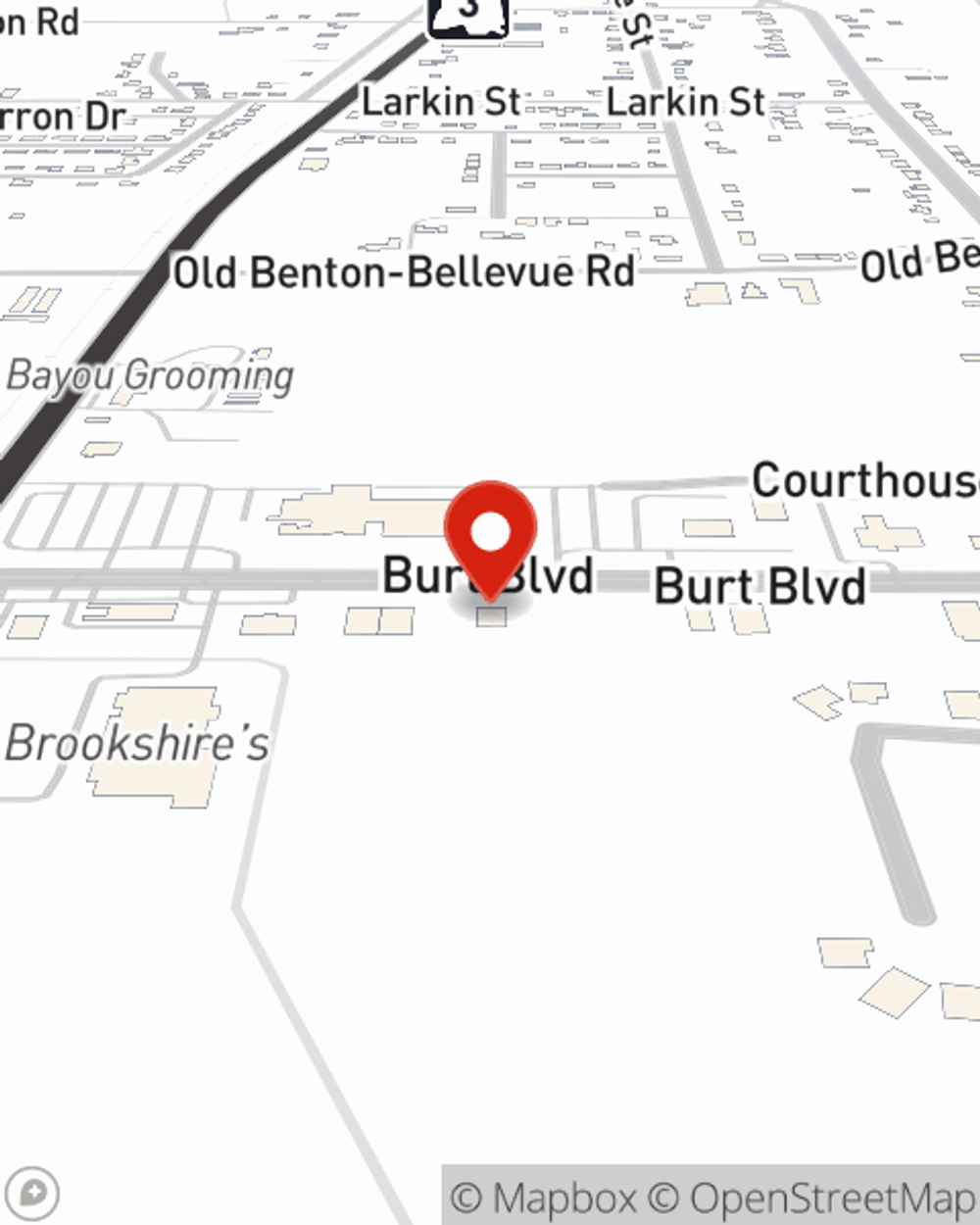

Get in touch with State Farm agent Lisa Dilts today to find out how one of the leaders in small business insurance can ease your worries about the future here in Benton, LA.

Simple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.

Lisa Dilts

State Farm® Insurance AgentSimple Insights®

Retirement plans for small business owners to consider

Retirement plans for small business owners to consider

Offering a retirement plan, including a SEP IRA, SIMPLE IRA or a 401k, is a great way for a small business to attract and retain employees.

Key employee coverage issues

Key employee coverage issues

The death/disability of a key person can have a dramatic impact in a smaller business. Consider these questions to help determine discount factor percentage.